May

Today, Chainlink powers over 900 unique oracle networks that secure tens of billions of dollars in smart contract value across the multi-chain ecosystem. Staking represents an innovation leap for Chainlink’s already time-tested oracle infrastructure that will help the network achieve virtuous cycles of cryptoeconomic security and we believe will in turn help fuel a new wave of smart contract development and adoption.

To understand Chainlink’s long-term economic model, it is important to understand the increasing economic efficiency of Chainlink oracle networks today and how the staking mechanism will advance Chainlink’s cryptoeconomic security. This post, based on Sergey Nazarov’s presentation, The Future of Chainlink, will walk through the fundamental challenge with oracle network incentives that Chainlink’s staking mechanism is designed to solve, as well as how this novel security model will help create an economy of scale around trust-minimized Chainlink services and smart contract innovation.

Before we dive in, it’s important to define three key terms:

For a technical deep dive into the cryptoeconomic incentive design around oracle node behavior, see section 9 of the Chainlink 2.0 whitepaper.

Multiple Chainlink oracle networks have now become profitable from the point of view of dApp fees. These are fees that are paid by dApps to consume Chainlink services. Considering that many blockchain networks continue to rely on block rewards to incentivize node performance, Chainlink oracle network profitability based on fees alone is a unique milestone. Some of the more widely used blockchains rely on block rewards anywhere from 60-70% percent.

Thanks to the efficiency of Chainlink’s Off-Chain Reporting protocol (OCR), the efficiency gains of blockchains that Chainlink oracle networks are running on, and increased user demand, certain Chainlink oracle networks have become completely profitable and don’t require a block reward or an oracle reward of any kind to operate.

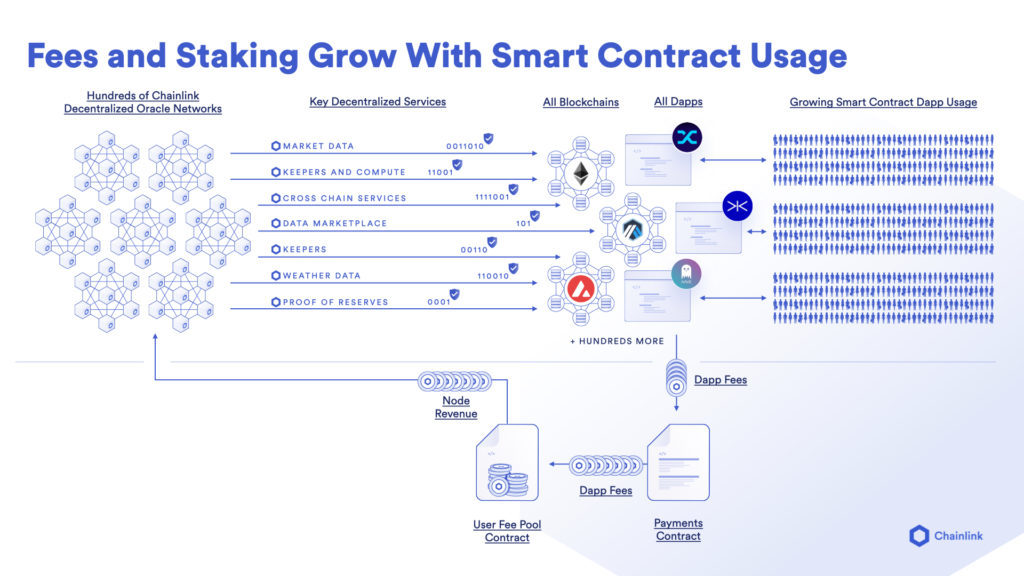

As dApps consume more Chainlink services, and new dApps are built to consume Chainlink services, this creates a logical dynamic where dApp fees flow toward Chainlink oracle node operators.

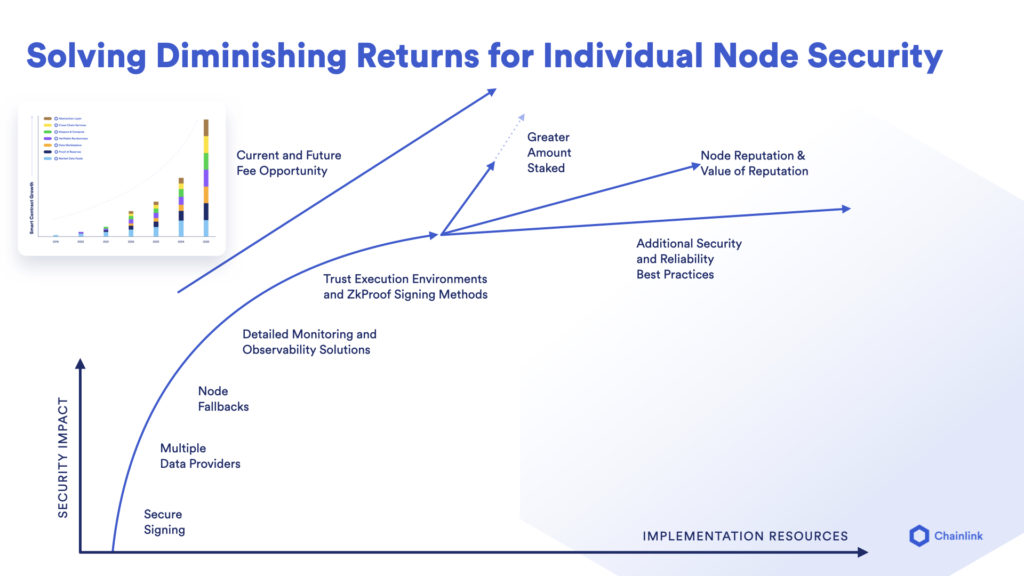

Because many Chainlink node operators are integrating robust infrastructure and security best practices for keeping their nodes live, they are starting to reach levels of efficiency that have diminishing returns on the improved security impact relative to their expense and can now be improved upon only through certain means.

From a purely economic point of view, the question is, what is the most impactful but least expensive security improvement? As node operators go up the security impact curve—implementing secure signing, multiple data sources, node fallbacks, detailed monitoring and observability, various signing schemes—they eventually hit a certain level of diminishing returns in terms of security impact.

However, as the amount of fees grows—based on the various new dApps that use Chainlink services and through the broader adoption of smart contracts—the current and future fee opportunity around Chainlink oracle networks is also expected to grow. The current future fee opportunity is the fees that node operators can earn by being top node operators in certain categories of computation, such as data validation and delivery, random number generation, and decentralized automation. Beyond higher quality nodes, the size of the oracle networks are also growing, which helps to enable increasingly larger networks for the more value-securing transactions and categories of transactions.

As fees increase, they can justify certain minimum levels of cost for security, for example having a certain secure signing capability, multiple data providers, or certain fallbacks. Over time, many nodes are expected to meet these minimums just like many nodes meet certain categories of security today.

The question then becomes, what are the other categories that can allow nodes to gain greater and greater fees? How do nodes acquire a greater portion of the current and future fee opportunity made available by the various decentralized services used by the growing collection of dApps and their users?

The fundamental answer to that, as described in our Chainlink 2.0 whitepaper, is two dynamics.

The first dynamic is node reputation and the value placed on that reputation. Node reputation is the history of low latency, accurate, and service agreement-meeting performance that nodes have achieved. A strong node reputation means they can offer a number of key metrics showing that they have and can deliver highly reliable, accurate data through various adversarial, high congestion periods and during daily operation. The better that a node is at uptime, at resisting adversarial situations, at delivering accurate information, and performing accurate computations, the clearer its set of differentiating factors.

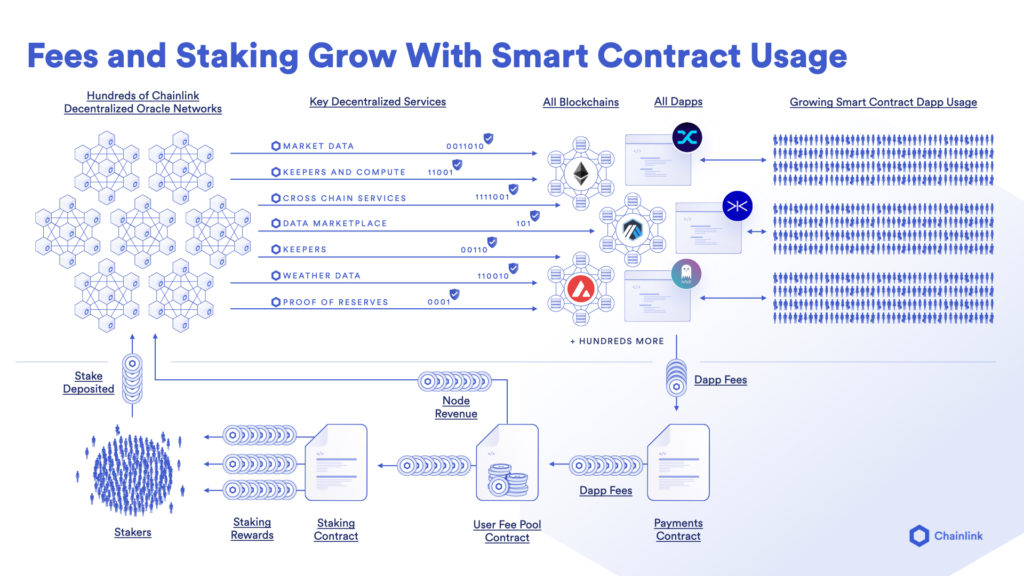

An additional set of differentiating factors, and possibly one of the largest differentiating factors, will be the amount of LINK staked by the node.

This is very similar to how blockchains work: certain chains have staking pools or individual stakers that provide a larger portion of stake and receive a larger portion of transactions. This is exactly the same principle. Those nodes and those staking pools that have more at stake, become eligible for more transactions.

In addition to meeting the security and reliability guarantees that the top nodes meet to access the most valuable future fee and current fee opportunity-filled oracle networks, node operators will also need to provide a reputation, which they will develop naturally over time if they perform well. The staking mechanism supplements the reputation system so that participants in the network can earn greater amounts of fees as a node operator that stakes, or as an oracle network that stakes, or as a pool that stakes.

This creates a very similar dynamic, where the ability to increase the amount of LINK staked creates the ability to get more fee opportunities, which actually contributes to having a better reputation, because the staking node operator would be processing more transactions and proving more about themselves over time.

This is the way that staking incentives are modeled to work for individual node operators. They will provide stake that will give security guarantees to various users, those users will see those security guarantees and want to deal with those nodes or those categories of nodes as oracle networks, and this will propel those networks and categories of nodes towards greater fee opportunities.

Over the long term, as fee opportunities grow and as more decentralized services are provided, a greater amount of dApp fees are expected to flow into the system to the node operators as node revenue and to stakers for providing cryptoeconomic security on those services.

Chainlink stakers can be any number of groups, including node operators themselves, individual users that stake, and pools that provide stake to the node operators. These staking groups are anticipated to receive the relevant staking rewards for providing their stake, which provides greater security guarantees in the same way that they’re provided in the world’s top staking blockchains.

This is obviously a very complex problem, because just as oracle networks generate a unique form of decentralized computation different from blockchains, the staking that is applied to that unique form of decentralized computation also needs to be unique.

On an oracle network level, as networks eventually arrive at a plateau around the utility of each additional security impact and cost, they can differentiate themselves as a network by being composed of nodes with the highest quality reputations and data providers with the highest quality reputation scores, and they can also provide collective staking from their network, either through a pool or through other mechanisms.

Greater stake provides the security guarantees that users will need for determining, alongside security best practices, decentralization, and high reputation scores, the superior network. By having more stake, the network is expected to have more reliability, it has more skin in the game, and more incentive to act correctly. That stake, just like it incentivizes proper operation in various proof of stake blockchains, incentivizes proper operation in the Chainlink Network. Likewise, the people providing the stake and the people providing the computation are uniquely incentivized to do that in their own unique way.

These dynamics will move that distinct oracle network closer to capturing more of the current and future fee opportunity, which is what they want to do and what they need to do in order to continue to get more revenue from the network. The massive impact of not only best practices and a strong reputation but having a larger amount of stake than others enables the same dynamics seen in larger proof of stake networks, where a greater portion of fees is sent to those mechanisms at a certain ratio that determines the additional security provided by that stake.

Ultimately, these dynamics depend on many factors, including the amount of fees, the amount of dApps, the amount of users of those dApps, the adoption of hybrid smart contracts, and the adoption of trust-minimized applications as a unique selling point to users.

The market size just for hybrid smart contracts is still in its infancy, and certain Chainlink oracle network operate efficiently enough that they’ve been able to achieve profitability in today’s cryptocurrency market. This is nothing to speak of when compared to the larger trust-minimized application market and all of the value that is poised to migrate to hybrid smart contracts in the future.